How to use a stop limit on Binance

With a stop limit order, you can automatically open or close your positions, even when you are not at your computer. In this article, we explain how the stop limit order works on Binance.

Where can you use a stop limit order?

- In the menu, navigate to trade

- Click on classic to open the trader

- Select the pair you wish to order

- Scroll down and select the stop-limit option from the order screen

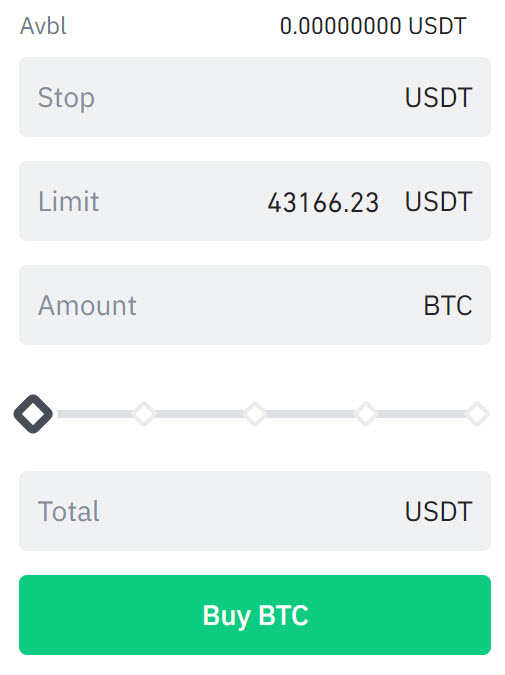

Stop limit order values

- Stop price: this is the price at which the order is activated, also called the trigger.

- Limit price: the price (or potentially better price) at which the order is actually executed.

- Quantity: the quantity you wish to buy or sell.

Stop limit for a buy order

You can use a stop limit order to buy a particular crypto at a certain price level automatically. This is useful when you see a strong level, and you believe that the price is likely to rise again from that level.

- Stop level: the stop level indicates the price at which the stop limit order triggers.

- Limit level: The limit level indicates the maximum price that you are willing to pay. This price only activates after the stop level hits.

It is advisable to place the limit level somewhat above the stop level. This increases the chance that the order will actually be executed, after the level has been reached.

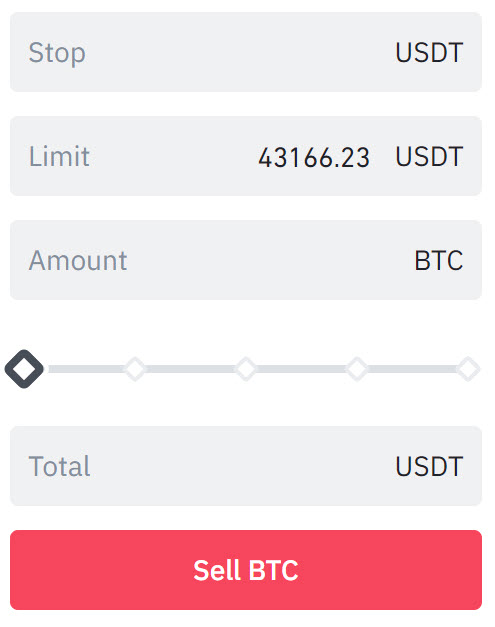

Stop limit for a sell order

You can also use a stop limit order to limit your losses or to take your profits at a certain level. Especially when you are actively trading, you can use a stop limit order to limit your risks.

- Stop level: the stop level indicates the price at which the stop limit order triggers.

- Limit level: the limit level indicates the minimum price you want to receive for the sale. The limit order only activates after the stop level hits.

Limit loss: if you would like to use the stop limit order to limit your loss, set the stop order level below the current price. It is advisable to place the limit level somewhat below the stop order level. If you place the limit level and stop level to close, there is a chance that the stop order will not be executed. This can happen when the price falls rapidly.

Taking profits: you can also use a stop limit order to take your profit. To achieve this, set the stop order level higher than the current price. It is advisable to place the limit level somewhat below this level. In this way, you increase the chance that the order will actually be executed.

View existing limit orders

You can view all your open orders under open orders. It is possible to delete existing orders here.

Under Order History, you can view all orders that were executed in the past.

Example of a stop limit order

You have bought bitcoin, and you expect that when the price reaches $50,000 it will fall further. In this case, you can use a stop limit order to take your losses at this level.

In this case, set the stop level at $50,000. The stop limit order is then activated when this level is reached. You can set the limit stop order at $49,800, for example. Binance will then try to execute the order at the best possible price, but it will never be sold for less than $49,800. If the price falls too much, the order may not be executed at all.

Want to read more about Binance?

- Click here to read the detailed Binance manual

- Read more about investing in Binance futures here

- In the extensive review we assess Binance