What are Binance leveraged tokens?

Binance leveraged tokens allow you to trade without collateral in the leveraged price of a crypto. When you utilize leverage, both your profits and losses can quickly rise. In this guide, we will explain how Binance leveraged tokens work.

What are Binance leveraged tokens?

Binance leveraged tokens are traded on the spot market just like normal cryptocurrencies. This means that you can easily buy and sell Binance leveraged tokens. However, there is a clear difference: Binance leveraged tokens represent multiple open positions on the perpetual futures market.

In the rest of this article, we will explain exactly how Binance leveraged tokens work.

How does the leverage work?

The leverage of a Binance leveraged token is variable and usually lies between 1.25 and 5. The leveraged tokens are automatically rebalanced. If the Binance leveraged token makes money, the profits are reinvested. If the position generates a loss, part of the position is sold. All this happens completely automatically and at random moments: this ensures traders cannot take advantage of this.

The leverage of a Binance leveraged token allows both your profits and losses to increase more rapidly. With a leverage of X3 and a price of $100, a $10 rise would result in a profit of $30, while a $10 fall would result in a loss of $30.

The danger of volatility

Volatility has a reputation for being good for the active trader. With the Binance leveraged token, the situation is slightly different: volatility can actually make your results much worse.

If the price of a normal crypto falls by 10% to 90%, a 10% increase is not enough to compensate for your loss. You would then end up at 99%.

This effect is stronger when the price falls by 90%; you then have to make a 900% profit to compensate for your loss.

Binance leveraged effects reinforce this effect further. After all, with a 10% drop, your result falls by 30%, so that the price then has to rise 43% to compensate for the losses instead of the usual 11%.

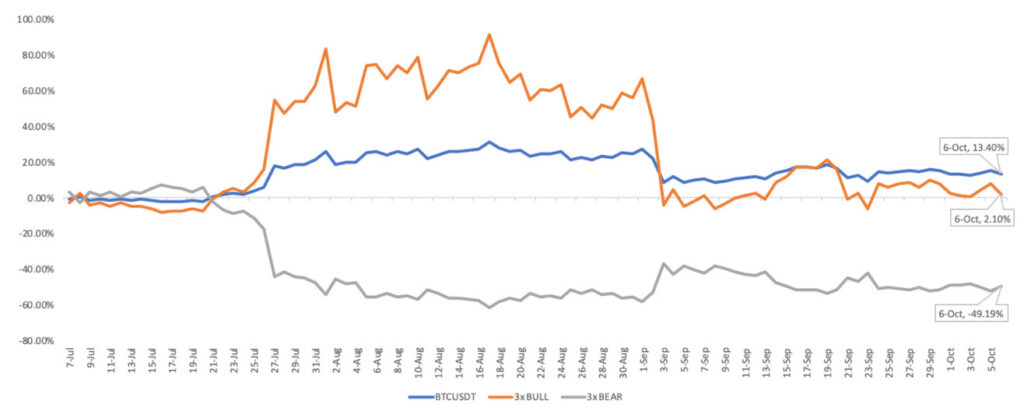

The chart below shows how volatility worsens your results with Binance leveraged tokens. Blue shows the results of a normal bitcoin pair, orange of a 3X leveraged buy position and blue of a 3X leveraged short position. As you can see, the leveraged tokens perform worse than the normal bitcoin pair in the long run.

Speculating on rising and falling rates

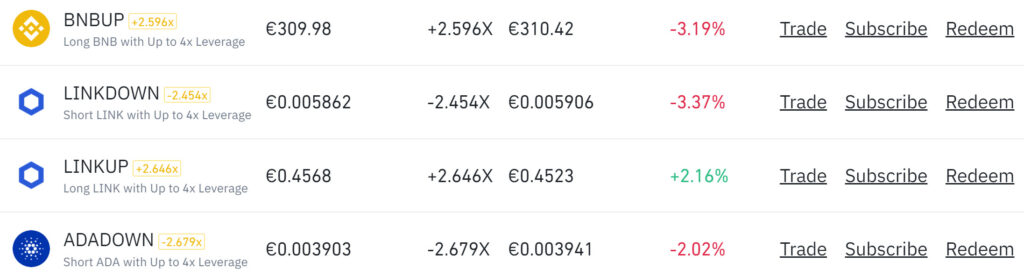

Binance leveraged tokens allow you to speculate on both falling and rising prices. You can recognize Binance leveraged tokens that you can use to speculate on a falling price by the letters DOWN. If a Binance leveraged token contains the letters UP, you are speculating on a rising price.

- With BTCDOWN you can speculate on a falling Bitcoin price

- With BTCUP you can speculate on a rising Bitcoin price

How to buy Binance leveraged tokens?

You can find Binance Leveraged Tokens in the Binance spot market, just like other cryptos. You can find the tokens by navigating to ETF within the Advanced Trading Interface.

A quick way to find the Binance leveraged token you want to invest in is to navigate to Leveraged Tokens via Derivatives. You will then see a list of all the Leveraged Tokens you can trade on Binance. Select the Leveraged Token you wish to trade and click the Trade button.

Placing an order for leveraged tokens works the same as placing an order for a normal crypto. Simply enter the amount you wish to invest and choose between a Market or Limit order. With a Market order, you buy the leveraged token immediately at the best available price, while with a Limit order you can specify a price you are willing to pay.

Before you can trade in Binance Leveraged Tokens, you must first take a quiz. You can only start trading once you have answered the questions correctly. Due to local regulations, Binance Leveraged Tokens are not available in all regions.

What are the advantages of Binance Leveraged Tokens?

At Binance, you can use leverage with different trading products: for example, by using futures or by trading on margin. One advantage of Binance Leveraged Tokens is that you are not at risk of liquidation. Nevertheless, it is important to remember that Binance Leveraged Tokens are very risky. Especially if you hold the tokens for a long time, you can lose a large portion of your investment in the long run.

Binance Leveraged Tokens are popular because of their simplicity. After all, you can buy the tokens in the same way as normal crypto coins.

What are the costs of Binance Leveraged Tokens?

When you buy Binance Leveraged Tokens, you will pay transaction fees just like normal crypto transactions. These costs never exceed 0.1%. In the article Binance costs, you can read in more detail how much costs you pay on Binance.

You also pay a management fee on Binance Leveraged Tokens. Binance Leveraged Tokens are futures, and it is customary to pay extra costs for them. On Binance, these costs are 0.01% of the invested amount, which comes down to 3.5% annually.

When you sell your Binance Leveraged Tokens again, it is best to do so directly on the market. If this is not possible, you can also use the redemption option. In that case, you pay an additional 0.1%.

The price of Binance Leveraged Tokens also includes funding fees. You do not pay these directly, and you do not notice them, but they do, of course, have an impact on your ultimate return.

How to invest wisely in Binance Leveraged Tokens?

It is important to remember that Binance Leveraged Tokens are not good long-term investments. Due to the impact of volatility on results, it is better to use unleveraged cryptos for long-term investments.

Binance Leveraged Tokens are particularly useful tools for capitalizing on a clear, sharp trend. When the market moves strongly in one direction, you can increase the profitability of your positions.

I would only recommend Binance Leveraged Tokens for advanced investors, as the impact of volatility on performance can sometimes be difficult to oversee.

Do you want to read more about Binance?

- Click here to read the Binance manual

- Read all about investing in Binance futures here

- Find out how to borrow money on Binance here