Is your money insured with Binance?

Before you start trading with Binance, you probably want to know if your money is insured with this exchange. In this article, we will briefly examine whether your cryptos and money are insured.

Is your money insured with Binance?

When you deposit money into your Binance account, this money is not insured. Binance is not regulated and has no bank licence: this means that there is no bank deposit guarantee scheme. If Binance were to go bankrupt, you would lose the amount of money in your Binance account.

Are your cryptos insured?

Your cryptos are not insured against hacks either. However, Binance does have the so-called Secure Asset Fund for Users (SAFU). Binance uses this fund to compensate users when a hack occurs.

This happened, for example, in 2019 when over 7,000 Bitcoins where stolen from users. Binance compensated this loss in its entirety with funds from the SAFU.

However, this insurance is no guarantee: it is therefore advisable to secure your Binance account. You can also store a part of your crypto assets in external wallets. In our article on protecting your account, you can read more about the security of your Binance account.

Insurance for counterparty risk

At Binance, you can also trade in futures. If the counterparty goes bankrupt (this happens when the financial obligations exceed the remaining balance), you can still lose money with a profitable future.

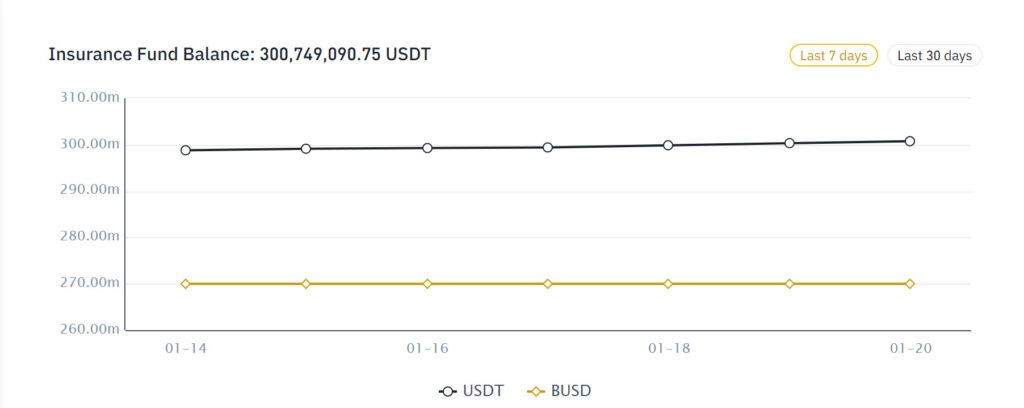

To prevent this as much as possible, Binance has created an insurance fund. You can examine how much is still in the insurance fund per crypto pair under Information and Insurance Fund History. At the time of writing, the entire insurance fund amounts to more than 2 billion.

You will only lose money if the counterparty cannot pay you back, when the insurance fund is empty. To reduce the risk, it may be wise to first check how much money is left in the insurance fund.

Insurance in America

The US version of Binance falls under the Federal Deposit Insurance Corporation (FDIC). This means that all USD deposits are insured up to an amount of $250,000. These balances are stored in custodial bank accounts.

Binance insurance conclusion

Binance has a good track record when it comes to security. Even when they were hacked in 2019, they compensated all customer losses. Still, there is always a risk that hackers gain access to your account. Therefore, it is wise to move large amounts of crypto to an external wallet: this ensures that you stay in control. In this article, you can read how wallets work.

Do you want to read more about Binance?

- Click here to read our extensive Binance review

- Find out if Binance is a scam

- Read our research on the reliability of Binance here

- Discover how to secure your Binance account here