Binance Liquid Swap platform explanation

Are you curious what the Binance Liquid Swap is and how you can use this platform? In this guide, you will learn everything about the Binance Liquid Swap platform/

What is a Liquid Swap?

The Liquid Swap is a DEX (decentralized exchange) built on Binance CEX (the central exchange). A Liquidity pool is an essential part of AMM or automated market makers that allow the trading of cryptos without the intervention of a third party.

You can use the Liquid Swap to exchange tokens at a lower cost. You can also contribute to the Liquidity pool and thus potentially achieve an additional return.

There is no traditional Orderbook in which all trades are recorded, as is normally the case in an exchange. Within a Liquidity Swap, it is the ratios of cryptos in a pool that determine the price. All users can deposit cryptos within a Liquidity Pool and thus contribute to the creation of a market.

The relationships between two cryptocurrencies determines the price. When one crypto becomes relatively more valuable, people trade more crypto for the one that is rising in value. Because of these active traders, the price within the liquidity pool remains equal to that of the central exchanges.

What are the benefits of Liquid Swap?

One advantage of the Binance Liquid Swap is its ease of use. Since the Liquid Swap is simply available within your Binance account, it is easy to participate in a liquidity pool. On Binance, you can choose from dozens of different liquidity pools; from stablecoins to more innovative coins.

Another advantage of Liquid Swap is that you receive BNB as a reward. You receive this in addition to a share of the trading fees. When you contribute liquidity to a Liquid Swap, you will also receive a part of the transaction costs on your account.

Another big advantage of the Liquid Swap on Binance is that you do not pay any fees for using the blockchain when you convert funds. This is often the case with other decentralized exchanges, such as PancakeSwap.

What are the risks of Liquid Swap?

A major risk of a Liquid Swap is impermanent losses. When you enter a liquid swap, it is in a certain ratio, for example 1 ETH against 100 DAI. You may face impermanent loss when the mutual ratios change. The direction of the price development does not matter here: the stronger the movement, the greater the loss.

You can hedge against this loss by only investing in less volatile, stablecoins. Within Binance, you can easily find Liquid Swap Pools that only hold stable coins. You should also consider bugs: there is no middleman and your crypto coins are held within a contract. If this contract is hacked or experiences a problem, you can lose your assets permanently.

Using Binance Swap

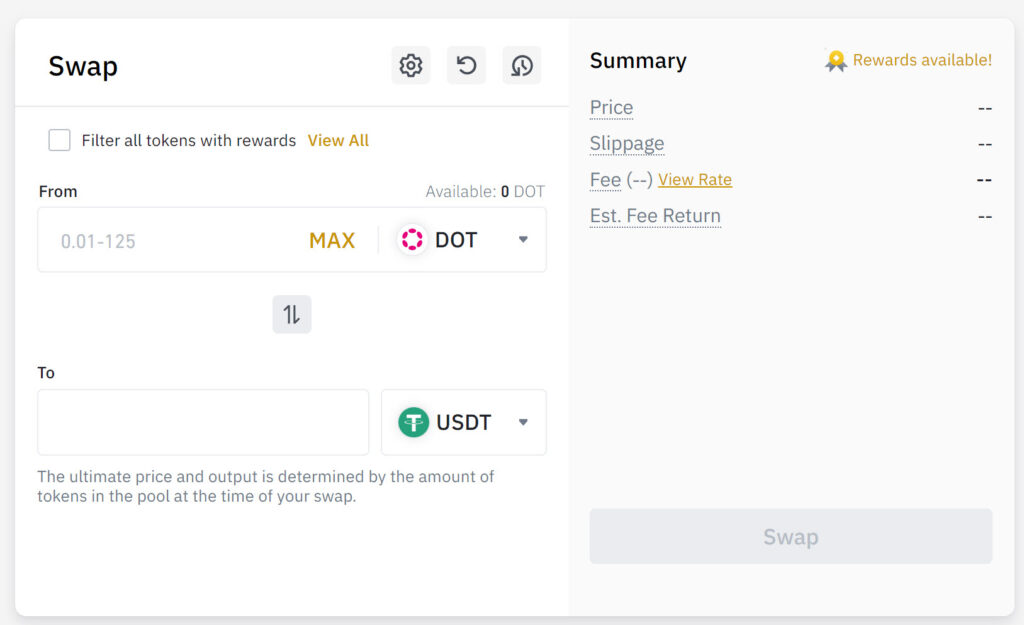

You can easily use Binance Liquid Swap. You can find this option under Trade and then Swap Farming. When you execute a trade, you will receive BNB as a reward. You can adjust the slippage tolerance by clicking on the gear icon (this indicates how much price difference you accept)

You receive up to 50% of the trading costs back in BNB, which means that trading via the Liquid Swap option can be a lot cheaper.

Adding liquidity to the liquid swap

You can also add liquidity to the Liquid Swap. To accomplish this, navigate to Liquidity Farming via Earn. Then navigate to High Yield and scroll down until you see the Liquid Swap option. Click on Go to Liquid Swap.

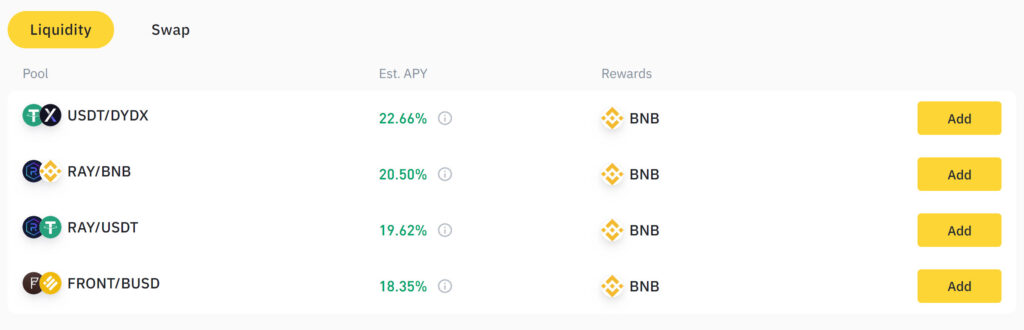

In overview, you can see to which Pools you can contribute liquidity. If you want to contribute liquidity, you can press the Liquidity button. Before you can participate in the Liquidity Pools, you must first complete a test so that you understand the risks 100%.

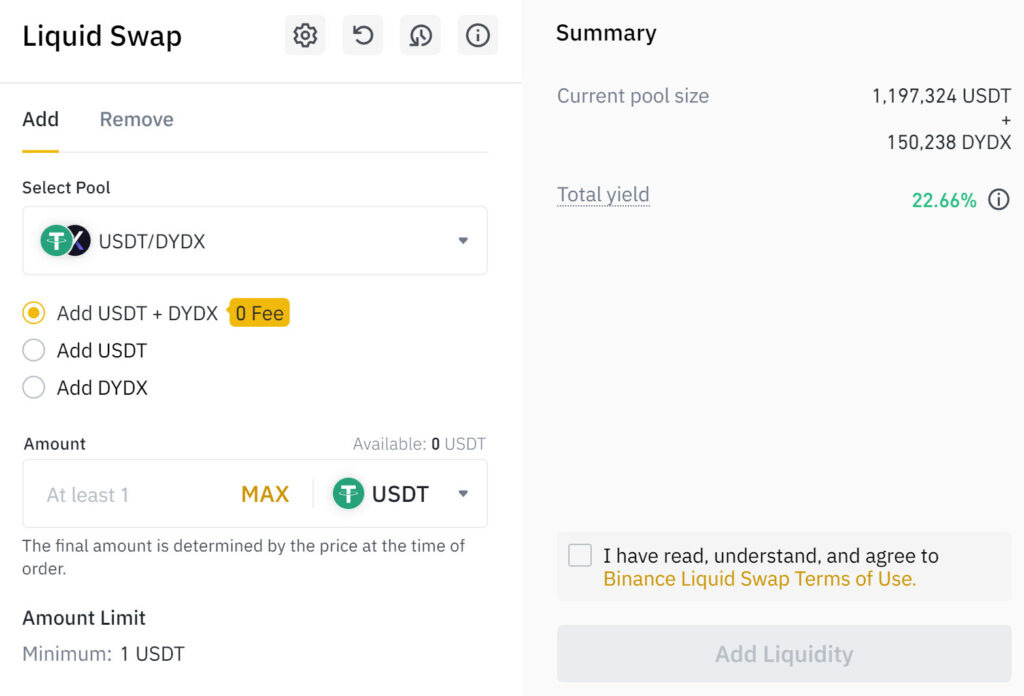

After you have completed the test, you can add liquidity to Liquid Swap. It is most advantageous to add both cryptos together, as you will not have to pay extra transaction fees. You can also choose to add one crypto only. Binance will then exchange the required other crypto, but you will have to pay a transaction fee for this.

The Total Yield indicates how much a pool would yield in 365 days, provided the results are the same as the day before. For each pool, you can see which reward coin you will receive for making your crypto available to a Liquidity pool. You can withdraw your crypto from the pool at any time.

Please note that you may lose money with liquidity pools due to exchange rate changes. The transaction fees that you receive for taking part in a Liquidity Pool can sometimes (partially) compensate these losses.

Do not forget that Liquid Swap is a risky option within Binance. You can make a high return, but it is also possible to lose a considerable amount if there is a high degree of volatility. Therefore, only invest in Liquid Swap with money that you can afford to lose.

Read more about Binance

- Read the detailed Binance manual here

- Find out how PancakeSwap works here: another decentralised exchange

- Discover other ways to make money with your cryptos here