Binance savings explanation: a fixed return on crypto

With Binance Savings, you can earn an attractive, fixed return on your crypto investments. In this article, we will discuss how Binance Savings works.

Why Binance Savings?

The savings rate on bank accounts is lousy: when you receive a positive interest, you are lucky. At the same time, with Binance Savings, you can quickly receive several percents in interest on your funds. In this article, we will discuss how Binance Savings works and what the possibilities are.

How can you join Binance Savings?

Before you can benefit from the possibilities of Binance Savings, you first need an account on Binance. You can open a free account with Binance by clicking here. By opening an account through this link, you benefit from our permanent 20% friend discount, which means you will pay less transaction fees permanently.

After you have opened an account, you also need to buy crypto you want to save. You can do this by depositing money into your account and by then using Trade and Convert to buy the relevant crypto. In our extensive guide, we will show you how to do this.

To join Binance Savings, navigate to Savings via Earn.

What is Binance Savings?

With Binance Savings, you lend your crypto to Binance: you can do this for a variable or fixed period. If you lock your assets for a longer period, Binance will pay you a higher interest rate.

You receive interest in the form of additional cryptos. Remember that cryptocurrencies constantly fluctuate in value. This means that the interest does not always outweigh a possible drop in the price in the meantime. Price fluctuations therefore pose a risk when you use Binance Savings.

Binance then uses your savings as any bank would: they lend them out at a higher interest rate or use them themselves for investments. There is also a counterparty risk with Binance Savings, as you can never be 100% sure that Binance will repay your money. However, if they would not do this, they would lose a lot of trust and it would probably mean the end of the entire crypto exchange.

Binance Flexible Savings Account

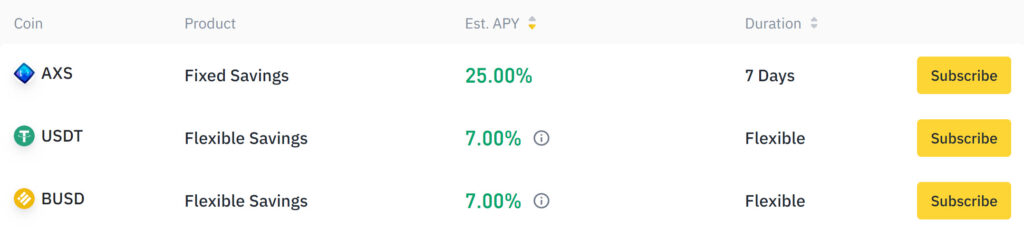

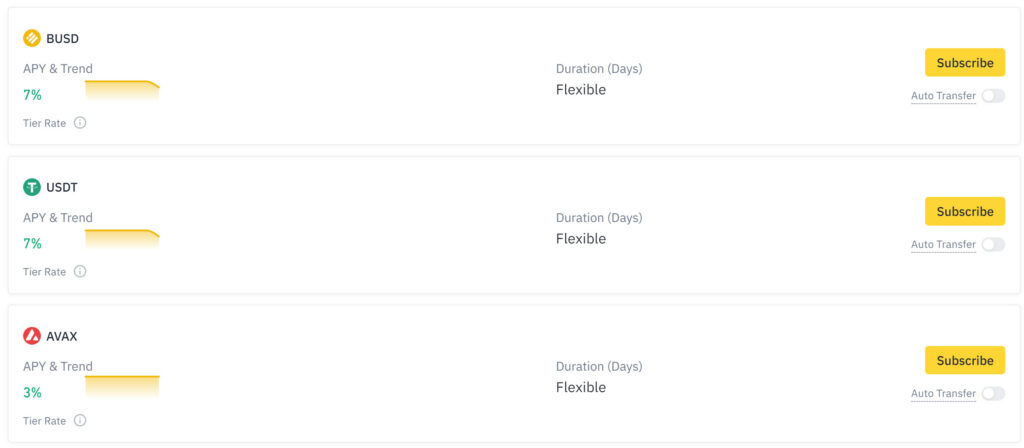

Flexible savings accounts are completely flexible: you can enter and exit this type of savings account at any time. Keep in mind that after you send a withdraw request, it may take until the next day before the funds are paid out. This means that you cannot quickly respond to a trend on the crypto market when your funds are stuck in a savings account.

The interest you receive on the flexible savings accounts fluctuates greatly. You will receive a lower interest rate on the more stable crypto coins, but you will benefit from lower risks. You can also put the more volatile crypto coins in your savings account and you will usually receive a higher interest rate on them. At the same time, you run a greater risk of losing a substantial amount of money due to a drop in the price.

The APY gives an indication of how much you would earn on a yearly basis, but this value only refers to the interest rate of the past 7 days. Therefore, remember that the interest rate can fluctuate and the result can be worse or better. It is also possible to use stablecoins within Binance Savings.

Pay attention to the tiers: when you save large amounts, the interest you receive decreases.

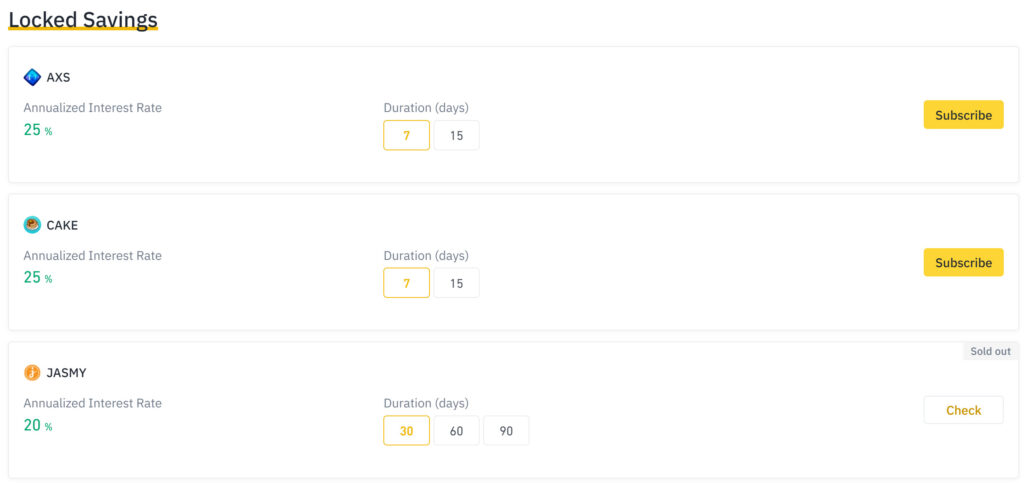

Locked saving accounts

With a locked saving account, you lock the crypto you want to save for a longer period of time. This is beneficial for Binance, as they can use that specific crypto amount for a certain period. You can choose from a period of 7, 14, 30 or 90 days.

The number of crypto coins you can put in a locked savings account is limited: at the moment of writing, there are 11. The interest you will receive on a yearly basis is a lot higher, especially for the volatile coins, and can be up to 50 percent! Of course, you will have to hope that the price of the cryptocurrency in question does not fall by an even greater amount in the same period.

Conclusion Binance Savings

I am a fan of Binance Savings: it offers a great alternative to holding unused cryptos in your wallet. Make sure you pay enough attention to the security of your Binance account to prevent hacks as much as possible.

Frequently asked questions about Binance Savings

Binance also runs a service where users can take out loans. By charging a higher interest rate to users who take out a loan, Binance can profit from the difference. Binance then pays you as a user a reward for providing the required liquidity.

Binance Savings can be ideal for users who hold a stablecoin without using it. You can quickly receive 6% interest on this amount, which is higher than you would receive on your bank account. However, there are also parties that specialize in offering crypto savings accounts. These parties pay higher interest rates, but are less well-known. You must therefore decide for yourself whether Binance Savings is an attractive option.

Risk and return are always linked. Binance Savings is one of the ‘safer’ crypto products, but this does not mean that Binance Savings is completely risk-free.

Binance lends savings out to users. However, users have to provide collateral for this, so Binance will normally not make a loss when things go south.

A bigger risk is that you have to keep the funds in your Binance account. Although Binance takes sufficient measures to protect accounts and funds, clever hackers still constantly try to gain access. However, on Binance you can benefit from the SAFU fund with which they compensate users who got hacked.

Do you want to read more about Binance?

- You can also achieve additional returns by staking assets

- Discover how you can make money with Binance Earn

- In this article you can read how the Binance platform works

- Read the extensive Binance review here